In today’s digital age, building a strong credit history is crucial. Credit cards can be valuable tools for managing finances, building credit, and making purchases. However, navigating the world of credit card offers can be overwhelming. If you’ve encountered the term “Gomercury.com pre-approved application,” this comprehensive guide is here to shed light on what it means and how to proceed.

Table of Contents

What is Gomercury (Now Mercury Cards)?

Previously known as Gomercury, Mercury Cards is a financial institution that issues unsecured credit cards. These cards are issued by First Bank & Trust, Brookings, SD, under a license from Mastercard® International Incorporated or Visa® USA Incorporated. It’s important to note that Gomercury has rebranded to Mercury Cards, and their website is now https://www.mercurycards.com/.

| Name | Gomercury Credit Card |

|---|---|

| Late Payment Fee | $41 |

| Balance Transfer Fee | $5 or 4% |

| Cash Advance Fee | $10 or 5% |

| Foreign Transaction Fee | 3% |

| Annual Fee | None |

| Annual Percentage Rate (APR) | 30.24% to 30.49% |

| Grace Period | 23 Days |

Understanding Gomercury.com Pre-Approved Applications

A “Gomercury.com pre-approved application” refers to an offer you might receive via email from Mercury Cards. This email signifies that, based on various criteria, Mercury Cards has identified you as a potential candidate for one of their credit cards. It’s important to understand that you haven’t formally applied yet.

What is a Gomercury.com Reservation Code?

The email you receive from Mercury Cards will likely include a unique identifier called a “Gomercury.com reservation code” (now referred to as a Mercury reservation code). This code is essential if you decide to move forward with the pre-approval offer and formally apply for a Mercury credit card.

Applying for a Mercury Credit Card with a Pre-Approval Offer

If you’ve received a pre-approval email with a reservation code and are interested in applying for a Mercury credit card, here’s a step-by-step guide:

- Visit the Mercury Cards Website: Head over to the official Mercury Cards website at https://www.mercurycards.com/.

- Navigate to the Application Page: Look for a section labeled “Respond to Offer” or similar wording that indicates pre-approved applications.

- Enter Your Reservation Code: On the designated application page, you’ll likely be prompted to enter your reservation code and the last four digits of your Social Security Number (SSN).

- Complete the Application: Once you’ve entered the required information, proceed to fill out the full application form, providing details like income and employment history.

- Submit the Application: After reviewing the information you’ve provided, submit the application electronically.

Mercury Cards Application Review Process

Upon submitting your application, Mercury Cards will conduct a hard credit inquiry. This inquiry will be reflected on your credit report and may slightly lower your credit score temporarily. Mercury Cards will then review your application details and creditworthiness to make a final decision. You should receive notification of their decision relatively soon after submitting the application.

Activating Your Mercury Credit Card

If your application is approved, you’ll receive instructions on how to activate your new Mercury credit card. This typically involves visiting the Mercury Cards website and providing some additional information to verify your identity. Once activated, you can start using your Mercury credit card to make purchases.

Benefits of Mercury Credit Cards

Here are some of the potential benefits of using a Mercury credit card:

- Potentially Easier Approval: Pre-approved offers can streamline the application process, potentially increasing your chances of approval compared to applying without pre-approval.

- No Annual Fee: Mercury credit cards typically don’t have annual fees, which can save you money compared to cards with yearly charges.

- $0 Fraud Liability: Mercury credit cards often offer $0 fraud liability, meaning you won’t be responsible for unauthorized charges made on your card.

- Free FICO Score Access: Some Mercury credit cards offer access to your FICO score, a valuable tool for monitoring your credit health.

- Mobile App Convenience: Mercury Cards typically offer a mobile app for managing your account, making payments, and tracking your spending.

Checking Your Gomercury.com (Mercury Cards) Application Status

In most cases, you’ll receive notification of your application decision shortly after submitting it. However, if you need to check the status manually, you can typically do so by following these steps:

- Visit the Mercury Cards Website: Go to the Mercury Cards website at https://www.mercurycards.com/.

- Log in to Your Account: If you haven’t already, create an account or log in to your existing

- k

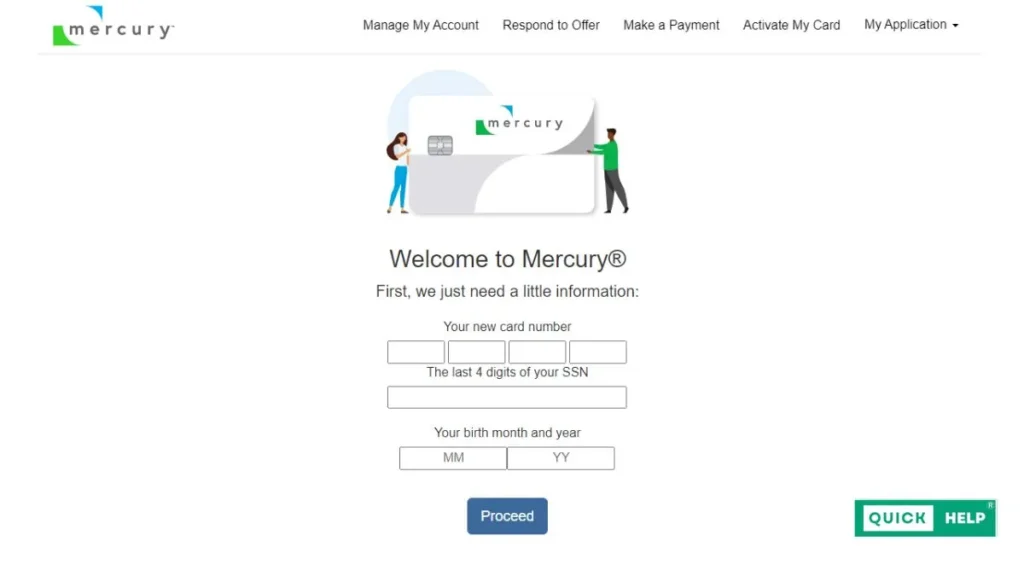

To activate your Gomercury credit card,

- Navigate to the Gomercury Credit Card Activation page.

- Input your credit card number, the last 4 digits of your SSN (Social Security Number), and your Birth Month & Year.

- Click the “Proceed” button to continue with the activation process.

Activation of your Gomercury credit card is mandatory for its utilization. Once the activation is successfully completed, you gain the ability to make payments globally.

Benefits of Gomercury Credit Card

- Accepted Worldwide: Your Gomercury Credit Card is accepted at over 40 million locations worldwide.

- $0 Annual Fees: There are no annual fees associated with the Gomercury Credit Card, providing a significant advantage to cardholders.

- $0 Fraud Liability: In case your Gomercury Credit Card is lost or stolen, you’re not liable for any fraudulent charges, offering peace of mind.

- FICO Score for Free: Gomercury provides access to your FICO score, allowing you to assess your creditworthiness at no extra cost.

- Mobile App: The Gomercury Credit Card mobile application is available for both Android and iOS devices. With the app, you can conveniently manage your card, check your balance, pay your bills, view statements, and redeem rewards.

- Gomercury Android App

- Gomercury iOS App

How to Check gomercury Pre Approved Application Status?

After submitting your Gomercury.com Pre Approved Application, you’ll promptly receive a decision. If further steps are required to check the status, follow the instructions below:

- Visit the Gomercury website.

- Sign in to your account.

- Navigate to the “My Account” section.

The website will display whether your application has been approved or not. For any inquiries, feel free to ask in the comment section for assistance.

Gomercury Credit Card Customer Service Number

For any queries or assistance regarding Gomercury, you can contact their customer service team using the following phone numbers:

- For Payment: Call 866-686-2158 or +1-706-494-5025

- For New Application Assistance: Call 833-766-4844

Making Payments on Your Mercury Credit Card

Managing your Mercury credit card involves making timely payments to maintain a good credit standing and avoid late fees. Here’s a breakdown of the various payment methods Mercury Cards offers:

1. Online Payments:

- Account Login: This method offers the most convenience and security. Sign in to your Mercury Cards account at https://www.mercurycards.com/ using your username and password. Navigate to the “Account Summary” page and locate the “Make a Payment” option. You can then proceed to submit your payment using a debit card or linked savings account.

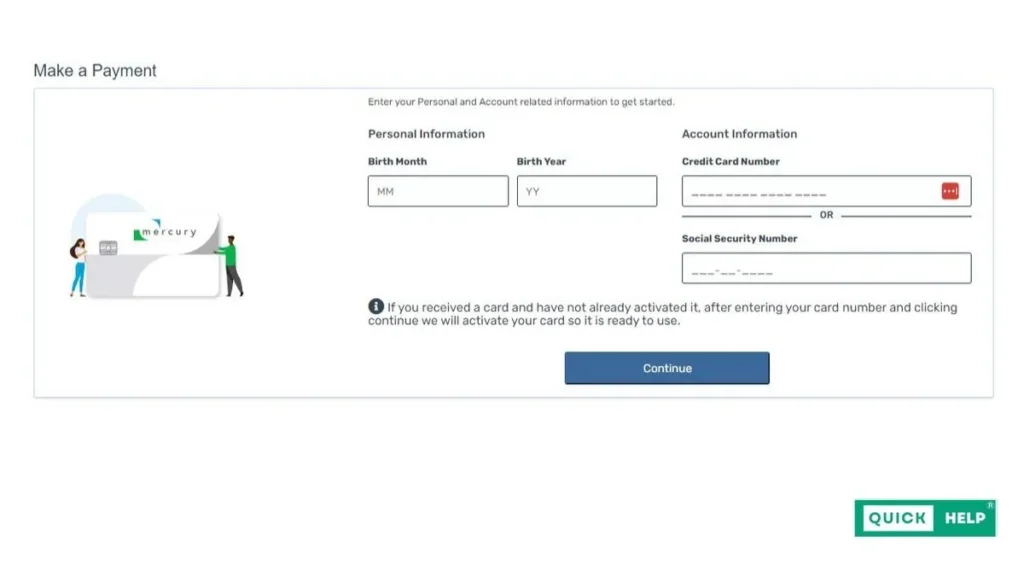

- Guest Payment: Mercury Cards may also offer a guest payment option on their website. This allows you to make a one-time payment without logging into your account. You’ll typically need to enter your birth month, birth year, credit card number, or Social Security number to identify your account and proceed with the payment using a debit card or savings account.

2. Mobile App Payments:

For on-the-go convenience, consider using the Mercury Cards mobile app to make your payments. Download the app from the App Store (for iOS devices) or Google Play Store (for Android devices). Once logged in, navigate to the payments section and follow the prompts to submit your payment using your linked bank account.

3. Automated Phone Payments:

If you prefer phone banking, Mercury Cards might offer an automated phone service for making payments. The specific number for this service might be printed on the back of your credit card statement or available on the Mercury Cards website. Be prepared to enter your account information using your phone keypad to authenticate and complete the payment process.

4. Autopay:

Setting up autopay ensures your payments are made automatically on your chosen due date. This helps avoid late payments and potential penalties. To activate autopay, log in to your Mercury Cards account and navigate to the payment settings section. You’ll then be able to link your preferred bank account and establish a recurring payment schedule.

5. Mail Payments:

While not the most efficient method, you can still send payments via mail. Make sure to send your payment well in advance of the due date to ensure timely processing. Include your full name as it appears on your account and the last four digits of your credit card number on the check or money order. Mail your payment to:

- Standard Delivery: Card Services PO Box 70168 Philadelphia, PA 19176-0168

- Overnight Delivery: Lockbox Services Box #70168 400 White Clay Center Dr Newark, DE 19711

Security Reminder:

For optimal security, online and mobile app payments are generally recommended. These methods offer stronger authentication protocols compared to phone or mail payments. Remember to never share your account login credentials or sensitive information over the phone or unverified channels.

Types of Mercury Credit Cards:

While pre-approval doesn’t guarantee a specific card, Mercury Cards offers a variety:

- Mercury® Rewards Visa® Card: This card might be suitable for those seeking rewards on everyday purchases. However, always check the current rewards program details on the Mercury Cards website.

- NEA® Mercury® Mastercard® and SEIU℠ Mercury® Mastercard®: These cards might be offered to members of specific organizations like the National Education Association (NEA) or Service Employees International Union (SEIU). Benefits and eligibility criteria may vary.

- Free Spirit® Points Mastercard®: This card might be a good option for frequent travelers, potentially offering points redeemable for travel rewards.

For a comprehensive breakdown of annual percentage rates (APR), annual fees, late payment fees, grace periods, balance transfer fees, cash advance fees, and foreign transaction fees applicable to each Mercury credit card, visit their Gomercury Credit Card Agreements page.

Alternatives to Mercury Credit Cards:

If you haven’t received a pre-approval offer or are exploring other options, consider alternatives like:

- Indigo Credit Card: Known for potentially catering to individuals with limited credit history.

- Milestone Credit Card: Another option for those seeking to build or rebuild credit.

- YourVerveCard: This card might be suitable for people with fair or average credit scores.

How to Increas your Gomercury.com credit card credit limit?

Increasing your Gomercury credit card credit limit is a straightforward process. Gomercury automatically raises your credit limit if you consistently pay your bills on time. You might be wondering, “What is the initial credit limit for the Gomercury Credit Card?” Well, the initial credit limit is determined based on factors such as your credit score, existing debts, and income.

Gomercury.com Login

To manage your Gomercury Credit Card, simply log in to your account. Once logged in, you can easily perform various tasks such as checking your balance, paying your bills, viewing your statements, and redeeming your rewards. Here’s how to log in to your Gomercury account:

- Visit the Gomercury.com Login page.

- Enter your username and password.

- Click the “Submit” button to access your account.

Important Considerations Before Applying:

- Credit Score: While Mercury Cards doesn’t publicly disclose the exact credit score needed for pre-approval, maintaining a good credit history generally increases your chances of approval for any credit card.

- Annual Percentage Rate (APR): Interest rates on Mercury credit cards can vary. It’s crucial to understand the APR associated with the specific card you’re applying for and factor it into your decision.

- Fees: While some Mercury cards boast no annual fees, there might be other charges like balance transfer fees, cash advance fees, and foreign transaction fees. Be sure to research the fee structure before applying.

Managing Your Mercury Credit Card:

Once you receive your Mercury credit card, responsible management is key:

- Make Payments on Time: Timely payments are crucial for building credit, avoiding late fees, and maintaining a good relationship with Mercury Cards.

- Monitor Your Spending: Regularly review your statements and track your spending to stay within your budget and avoid overspending.

- Utilize the Mobile App: Mercury Cards likely offers a mobile app for convenient account management, making payments, and monitoring your credit score (if applicable).

Additional Resources:

- Mercury Cards Customer Service: For any questions or concerns, contact Mercury Cards customer service through the options listed on their website (https://www.mercurycards.com/).

- Financial Literacy Resources: Consider exploring resources from reputable organizations like the Consumer Financial Protection Bureau (CFPB) to gain a deeper understanding of credit cards and responsible credit management practices.

Conclusion:

Understanding pre-approved applications and the functionalities of Mercury Cards empowers you to make informed decisions. Remember, building a strong credit history takes time and responsible credit card use. By carefully considering the information presented here, you can navigate the world of Mercury Cards and potentially leverage them to your financial advantage.

FAQs:

What is Gomercury Credit Card?

- Gomercury Credit Card is an unsecured credit card issued by First Bank & Trust, Brookings, SD, under a license by Mastercard® International Incorporated or Visa® USA Incorporated.

How can I apply for a Gomercury Credit Card?

- You can apply for a Gomercury Credit Card online by visiting the official website and following the application process.

What are the benefits of Gomercury Credit Card?

- Benefits include worldwide acceptance, zero annual fees, zero fraud liability, access to FICO score for free, and a mobile app for convenient management.

- The initial credit limit varies and is determined based on factors like credit score, existing debts, and income.

How can I check my Gomercury Credit Card application status?

- You can check your application status by logging into your account on the Gomercury website or by contacting customer service.

Is there a fee for late payments on Gomercury Credit Card?

- Yes, late payment fees apply. It is recommended to pay bills on time to avoid additional charges.

Can I increase my Gomercury Credit Card credit limit?

- Yes, Gomercury may automatically increase your credit limit if you consistently make timely payments.

What should I do if my Gomercury Credit Card is lost or stolen?

- If your card is lost or stolen, contact Gomercury immediately to report it and request a replacement.

Are there any foreign transaction fees with Gomercury Credit Card?

- Yes, there may be foreign transaction fees applied to purchases made outside of the United States.

How can I contact Gomercury customer service?

- You can reach Gomercury customer service by calling the provided phone numbers or visiting their website for support options.